Invest

Summary 2014

- Drop in the oil price and large currency fluctuations

- Good conditions in stock markets continued in 2014

- The Ferd Invest portfolio was broadly in line with its benchmark index

- Low interest rates and falling commodity prices led to share price rises continuing for the time being

Markets

2014 was another year in which Nordic stock markets delivered positive returns. Share prices rose by less than in 2013, but Nordic stock markets gained between 21% (Copenhagen) and 5% (Oslo) in local currency terms. When these rises are measured in Norwegian kroner terms, they are even greater than those seen in 2014. There were dramatic fluctuations in the price of oil and in the currency markets. First and foremost, the American dollar strengthened significantly during the course of the year, while oil fell from a high of around USD 115 to under USD 50. Interest rates were close to zero in most markets and central banks continued to provide liquidity. The combination of cheap capital and falling commodity prices was again the most important reason for which global stock markets rose for another year.

Investment Return

The market value of Ferd Invest’s portfolio increased by 13.9% in 2014, which was 1.3% less than our benchmark index. Our best investments in 2014 were Outokumpu, Autoliv, Kone, Novo Nordisk and Opera Software. Our weakest investments were to be found in the energy sector and among companies exposed to the Russian economy. The main reasons that Ferd Invest's performance fell slightly short of the market as a whole in 2014 were its investments in companies such as PGS, Nokian Tyres and Subsea 7.

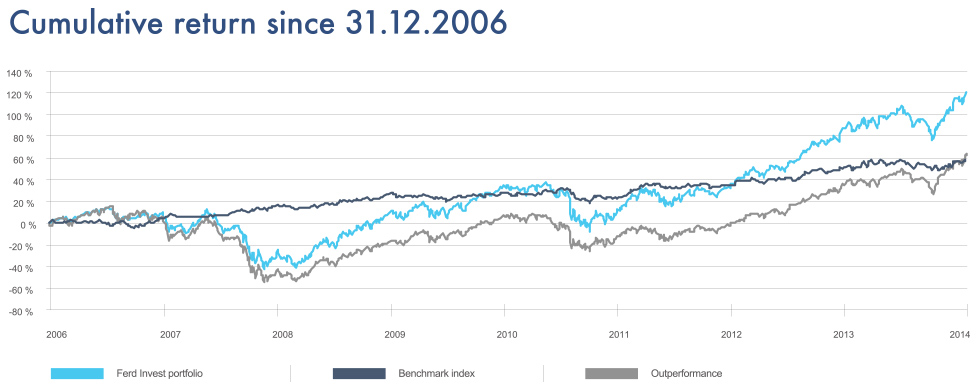

Ferd Invest’s long-term performance continues to measure up well. Over the last five years, the portfolio has achieved a return of 96%. The market we compare ourselves to has increased by 91% over the same period. Since 2006, the portfolio has increased by 114%, during which time our benchmark index has increased by 56%.

Portfolio

The market value of the Ferd Invest portfolio at the close of 2014 was NOK 5.2 billion. The portfolio’s investments are divided between the three Scandinavian stock markets, as well as the Helsinki stock market. The largest investments at the close of 2014 were Opera, Autoliv, Kone OY, Assa Abloy and Hexagon, and these investments accounted for around 40% of the portfolio at year-end. Our benchmark index is the MSCI Nordic Mid Cap Index.

Organisation

The Ferd Invest team currently has three members. Gaute Garshol, our colleague for many years, sadly passed away in May 2014. Samson Sørtveit joined the team as a portfolio manager in May 2014. In 2014 the Ferd Invest team was made up of Samson Sørtveit, Lars Christian Tvedt and Alexander Miller.

Future Prospects

A year ago, we indicated that the market no longer had many worries, and that this made us doubtful about whether strong rises would be seen in 2014. 2014 turned out in many ways to be a continuation of 2013. We are now witnessing the seventh year of rising markets. Bull markets as they are called rarely die of old age; they rather die due to weaker earnings and excessive optimism. We are approaching a point where there is a risk of both of these. Interest rates around the world are largely set at around zero. With capital so cheap, there is a real risk that people will make “stupid” investment decisions, and that bubbles will therefore form. The stock market is always a candidate for entering a bubble. We have reached the stage in the cycle where a correction needs to be prepared for. Bubbles will form, but it is difficult at present to say when. Low interest rates, falling commodity prices and central banks pumping liquidity into the financial system are probably good enough medicine to ensure that markets will continue to rise in 2015 as well.