Hedge Fund

Summary 2014

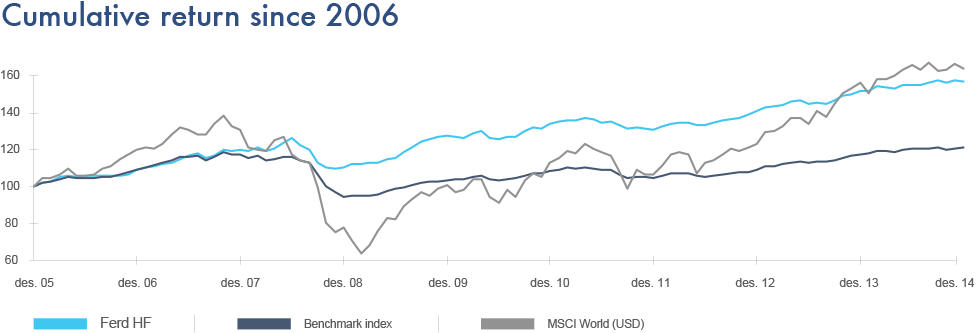

- The hedge fund portfolio's return of 3,5% in USD in 2014 is deemed satisfactory

- High activity and significant changes to the portfolio during the year

Market

2014 was characterized by macroeconomic uncertainty, monetary interventions and geopolitical issues. Entering the year, many were expecting the US to embark on an interest rate hike cycle. However, Fed kept the interest rate unchanged, we witnessed a significant fall in long-term interest rates and US equity markets had a strong year. As tapering took place and the US ended their quantitative easing, new stimulus was introduced in Japan and in the Eurozone. World equity markets had a decent year overall, with the MSCI World returning 9,8% in local currency. Due to the significant appreciation of the US dollar during the year, MSCI World in USD was up 4,9%.

2014 was a very difficult year for Russia. The declining oil price and economic sanctions from Europe due to the conflict with Ukraine culminated in December, when the currency collapsed. The ruble depreciated 85% against the USD during the course of 2014.

The oil price (Brent) peaked at 115 USD per barrel in June, and was the center of attention for a large part of the second half of the year. Volatility in the markets picked up over the summer as Fed continued its tapering and growth outlook in Europe continued to be weak. In September, the ECB unexpectedly announced an interest rate cut, and simultaneously introduced quantitative easing measures indicating they were willing to double ECB´s balance sheet. Coupled with continued growth in the supply of oil and demand weakness from China and other emerging countries, this lead to a steep decline in the oil price in the fall. OPEC´s surprise decision not to cut production in November triggered a further sharp decline in the oil price. Unsurprisingly, this lead to strong pressure on commodity related currencies, including a significant weakening of the Norwegian Kroner, which depreciated 23% against the USD in 2014.

The broad HFRI Composite Index was up 3% in 2014. Following three years of muted performance for trend following strategies, many investors had questioned their viability. However, these funds ended the year as the best performing strategy, with a very strong second half of the year, profiting from falling interest rates, the sharp fall in the energy prices and currency trends, particularly the continued appreciation of the USD.

Portfolio

The hedge fund portfolio is denominated in USD and returned 3,5% in 2014, 0,4% ahead of the benchmark index. The portfolio is currency hedged to Norwegian Kroner internally against our treasury department, and the portfolio result in Norwegian kroner was 103 million. The market value of the portfolio was 2,87 billion NOK as at the end of 2014.

Following a year of moderate changes to the portfolio in 3013, 2014 was an active year with significant changes. We have focused on concentrating the portfolio by reducing the number of funds, which has gone down from 26 to 20. Top ten concentration has also increased. During this process we have been looking to construct a portfolio containing complementary strategies and funds, with a particular emphasis on funds that we believe have appealing characteristics in more challenging market environments.

The largest positive contribution to portfolio return came from a multi strategy fund. In line with the strategy indices for hedge funds, the portfolio´s two quantitative funds also had strong performance and contributed nicely to returns. Exposure to reinsurance was also a good contributor to returns.

The sharp rotation from value/momentum stocks to value at the end of Q1 impacted several of the portfolio´s equity centric funds. Although performance in 2014 for this group overall was satisfactory, one manager became the largest detractor to performance for 2014. It was also a challenging year for the portfolio´s event related exposure. This was not driven by certain names commonly held by event oriented fund last year, but rather driven by a small number of idiosyncratic positions as well as factors related to the manager´s portfolio construction.

Organization

As of February 2014, the team was expanded by one person.

Outlook

We expect markets to focus on central bank policy also going forward. The oil price will be a key factor with regards to inflation and global growth going forward. A modest pick up in growth can provide further support for equity markets, which are currently at record high levels in nominal terms and also relatively high in a historical pricing context. Hence, they are vulnerable to disappointments in the year to come, and interest rate hikes from the Fed can potentially lead to a re-pricing of risky assets. Consequently, this could lead to higher volatility and range of outcomes in markets going forward.

We will continue our effort to concentrate the portfolio further in 2015. We will still hold a diversified portfolio, but where we aim to increase the reward of good selection.